“An ember is all it takes to keep going and make the decision to never give up.”

These words from famous adventurer Bear Grylls (as he spoke at Applied Net 2023) remind us that our inner strength or “fire” gets us to the other side of life’s obstacles stronger than we were before, which is also the case for the insurance industry. As the world evolves, so does the insurance industry. Despite threats like worldwide political and economic uncertainty, climate change, cyber threats, the AI hype cycle, and talks of a looming recession, our industry saw record-breaking growth in 2023.

Our Industry Remains Resilient – and Growing

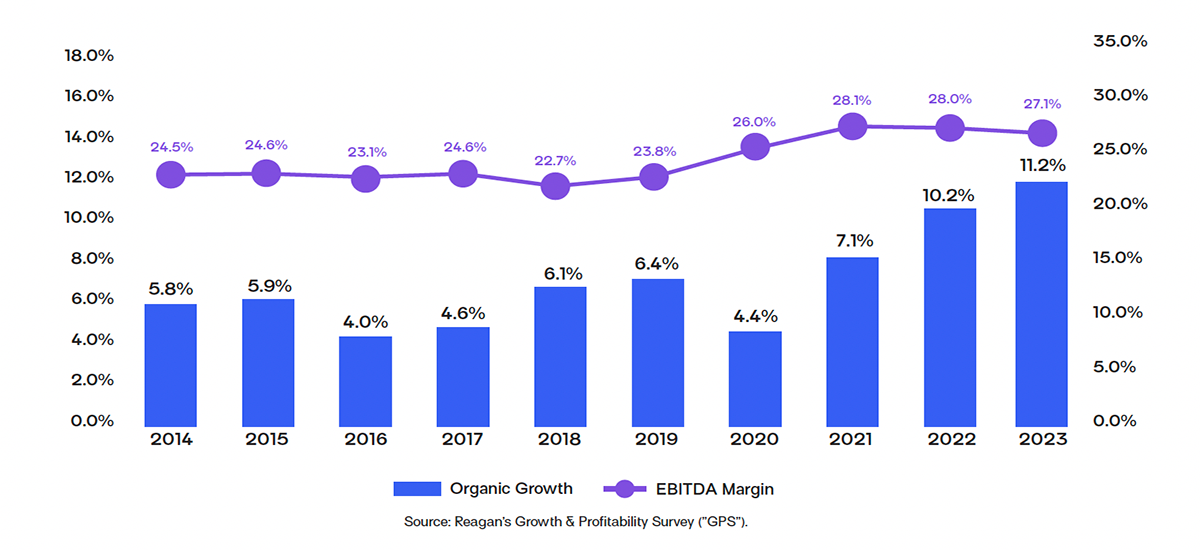

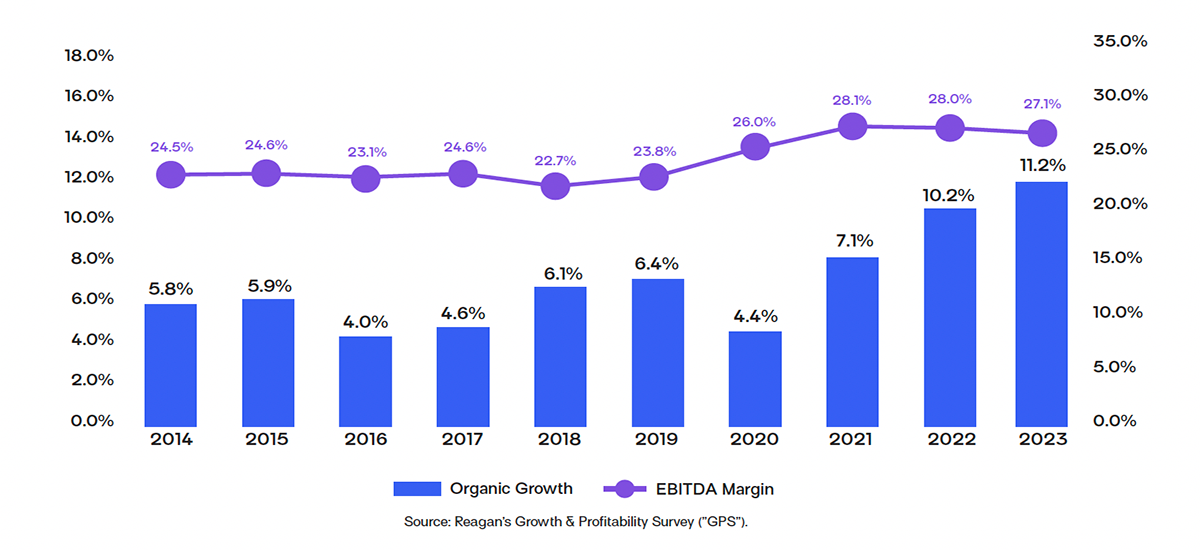

According to Reagan Consulting, organic industry growth soared to an all-time high of 11.2% in the second quarter of 20231. A leading driver of this was commercial lines, posting impressive organic growth of 11.7%, the highest Q2 results in Reagan’s survey history. Not far behind was personal lines, which saw record-breaking growth of 10.6% for the same period. And finally, the Benefits sector also picked up, returning to higher growth rates after the COVID-19 pandemic.

One of the challenges that comes with the blessing of record-high growth in the insurance field is that we have a very – like, very – low unemployment rate of 1.4% in our industry2. In a historically tight labor market, equipping your scarce talent with the right technology and tools is more important than ever. As we work together on solutions to attract a new generation to the insurance industry, we must remain focused on empowering the current generation of insurance professionals to win in the Digital Growth Era of Insurance.

Making Your Agency More Valuable

At Applied, we’re obsessed with a simple equation that we believe aligns us with you. We’re committed to creating technology that helps drive higher-than-average revenue growth at a lower-than-average cost structure and, therefore, helps you make your agency more valuable. We use this simple framework to guide our investment decisions.

Shortening the Digital Roundtrip of Insurance Makes You Even More Competitive

One of the most powerful ways to fulfill our promise of becoming Your Indispensable Growth Partner is to scale our insurance technology that connects the Digital Roundtrip of Insurance. We introduced this concept last year (check out Your Winning Ticket to the Digital Roundtrip of Insurance eBook), but the gist is we’re delivering value-driven solutions that complete the roundtrip of insurance so you can compete and win at digital speed.

As we’ve continued down the path of connecting the Digital Roundtrip of Insurance, we’ve realized that the greatest value comes from shortening – or accelerating – the full roundtrip for your personal lines, commercial lines and Employee Benefits books of business. Doing so creates incredible power and value for you, helping you know more, work on the most valuable tasks, execute faster, deliver more value to your clients, and drive more profitable revenue growth for your business.

Take a look at our NEW! The Digital Growth Era of Insurance Is Now eBook to learn how to accelerate the Digital Roundtrip of Insurance, so your business can step into the Digital Growth Era with the latest technology by your side.

-

^1. Key Trends in Insurance Brokerage & Best Practices for Competing with Scale, Trusted Choice Independent Insurance Agents, November 2023.

-

^2. Big ‘I’ and Reagan Consulting Release 2023 Best Practices Study Update, Big I, October 2023.